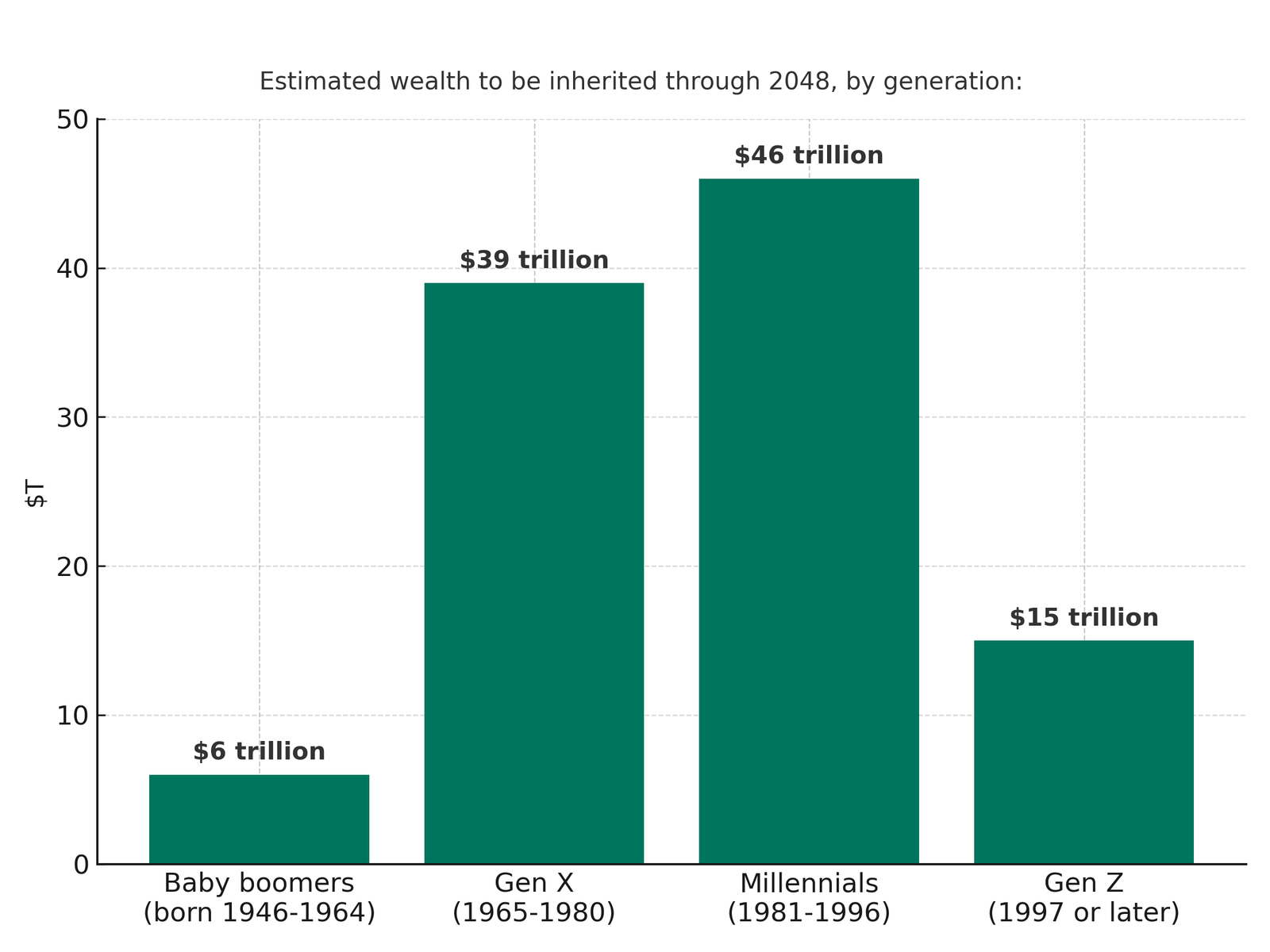

This massive shift is known as the Great Wealth Transfer; a generational reallocation of assets from baby boomers to their heirs, reshaping the financial landscape for families, trusts and their financial advisors.

According to the IRS Personal Wealth Study, estates valued over $11.4 million hold 27.1% of their total assets in real estate, distributed across three key categories: primary residences, investment properties, and business-related real estate such as industrial, commercial, office buildings and farmland.

Meanwhile, J.P. Morgan Asset Management reports that, among middle and upper-middle-class households, real estate is the majority of non-liquid assets and represents a substantial share (50-70%) of overall net wealth.

It’s commonly estimated that 30% to 50% of inherited real property is sold within the first year. More often than not, these properties contain substantial deferred maintenance and other preventable deficiencies leaving them to be sold in fair to poorcondition.

Financial advisors are experts at helping clients achieve their goals through strategies centered on cash, stocks, and insurance. But what about the home, the land, the investment properties, and the business real estate? These tangible assets often represent a substantial portion of a client’s net worth, yet most estate plans focus solely on their legal transfer.

What’s often missing is strategic direction and adequate funding for the preservation, growth, and optimization of these holdings. Without a proactive plan, valuable real property may be underutilized, mismanaged, or even lost across generations.

Inheriting real estate can be difficult. Particularly for those with conflicting needs or without the required time, experience or finances to make the most of their gift.

Hartcrest works alongside financial, tax and legal advisors to tailor solutions that prepare real property for sale, secure long-term income or enable a hassle-free transition.

From initial portfolio review to final execution, we manage every detail to ensure alignment with a comprehensive wealth transfer strategy. This integrated approach mitigates risk and allows us to skillfully guide even the most complex circumstances.

We understand that early, thoughtful planning can make all the difference. By removing the burden of upfront expenses, we aim first to earn trust, so when property transfers occur, Hartcrest is chosen to lead the way.

Whether it’s primary residences, investment properties, or business-related real estate, our multidisciplinary expertise uniquely positions Hartcrest to be able to protect real property and grow it wisely.

Any real property transfer requires transparency and neutrality. Our comprehensive analysis, ongoing reporting and proactive communication provide clarity and confidence for all parties.

Recognizing that funding is often the missing link in property optimization, Hartcrest eliminates the stress of out-of-pocket expenses and prepares real property for what’s next by adding tangible value.1

Hartcrest fronts the cost to improve real property so clients can maximize its value. As a fiduciary, our process aligns interests through a transparent, success-based fee structure paid directly from the transfer.1

After being an integral part of unlocking over $1B in real property equity over the past 20 years, there’s little we haven’t seen. Our curated vendor network includes architects, trade contractors, engineers, political and environmental consultants, and everything in between.

1As a fiduciary, we have the legal obligation to act solely in our client’s best interest, putting client’s needs before our own or any other party’s. Fiduciary duties include but are not limited to honesty, fair dealing, good faith, integrity, disclosure, confidentiality and performing all actions with reasonable skill, care, diligence and thoroughness.

Results may vary. Hartcrest offers no guarantee or warranty of results. Subject to additional terms, conditions and eligibility. Because our personalized approach is based on your unique property and situation, terms, conditions, and our fee agreement will be provided to you in writing should your property meet eligibility. Eligibility and proposed capital commitment are subject to the discretionary underwriting approval made by Hartcrest, its subsidiaries, affiliates, assignees and/or limited partners. Exclusions apply and not every property will be deemed eligible.

Typically, and subject to additional terms, conditions and eligibility, your current sale price/original sale amount represents the amount you could reasonably expect to collect if your property were sold “as is.” The additional net profit you receive is calculated by subtracting your original sale amount, the cost of the improvement plan, and our transparent fee from the final sale proceeds.

Nothing on this Website constitutes investment advice, performance data or any recommendation that any particular transaction or investment strategy is suitable for any specific person. No assurances can be made regarding the accuracy of any future prediction. Any investment program may be volatile and can involve the loss of principal. Not all past forecasts were, nor future forecasts may be, as accurate as those presented. Past performance is no guarantee of future returns.

3

| Sale Proceeds | Capital Improvements | Basis | Taxable Capital Gains | Capital Gains Tax* | Net Proceeds | After-Tax Difference | |

|---|---|---|---|---|---|---|---|

| As-Is | $800,000 | $0 | $200,000 | $600,000 | $193,800 | $606,200 | – |

| Hartcrest | $1,000,000 | $100,000 | $300,000 | $700,000 | $226,100 | $773,900 | +$167,700 |

*For this extremely simplified illustrative example, we are using the highest income brackets for a resident of California (20% Federal and 12.3% State).

Any tax benefits, including potential reductions in capital gains taxes, depend on individual circumstances and applicable tax laws, which are subject to change. You should consult with your tax advisor, CPA, attorney, or financial professional to understand how selling your property and any improvements made may impact your tax situation. Results may vary. Hartcrest offers no guarantee or warranty of results and does not provide tax, legal, or financial advice.

Copyright ©2025 | Hartcrest Ca/DRE # 0188271